Sale-Leaseback

Recapturing Capital

One of the best reasons for users of commercial real estate to purchase real estate (become an owner-user) is the sale-leaseback as an exit.

What is a sale-leaseback?

This occurs when a business sells the real estate that they’re occupying to an investor, and leases the space from the investor at a pre-negotiated rate.

Why would someone want to do this?

For sellers, there are a lot of reasons to exit your real estate this way. The first is for a capital injection into the business, if times are tight for cash, this can help redeploy capital to support the core business. Of course, the cash injection can be used in other ways, possibly to buy out partners, help fund the opening of new locations, diversify out of your core business or even for owners to retire.

Most cases we see are prudent owners who are ready to retire and want some cash to fund their retirement. They have the legacy of their business, and they have the freedom to pull the equity they’ve built up out of their real estate asset. Users who lease for the course of their business don’t have this advantage, so this is the most common reason we see people exit in this way.

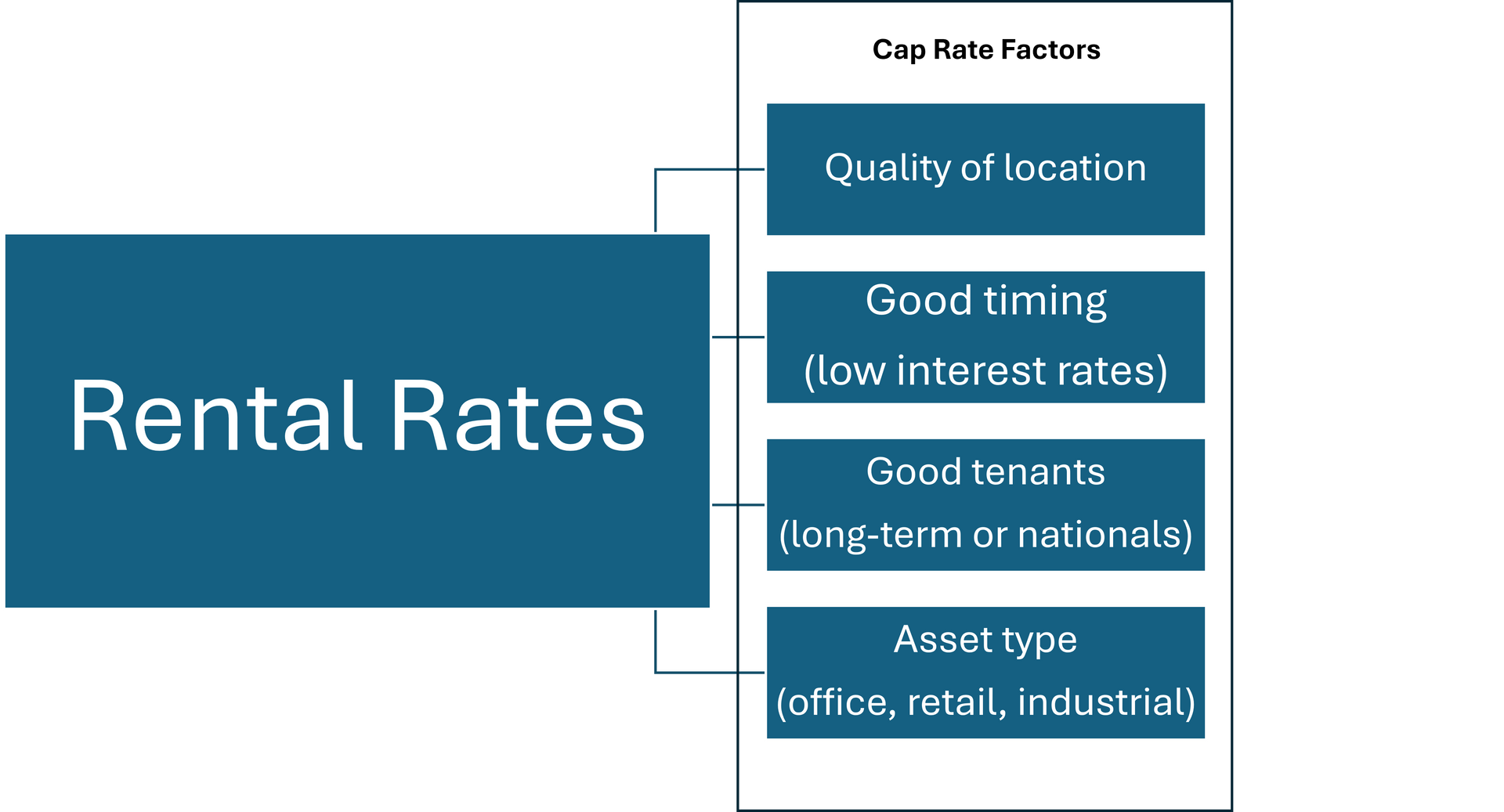

For buyers, the reason to enter into one of these deals is to secure an investment property with a long term tenant. The flexibility in leaseback terms can create upside for both parties to reach a mutually beneficial arrangement. Considerations when purchasing a property in this context are much the same as buying other investment properties.

1.Quality of the asset and any major upcoming capital expenses

2.The creditworthiness of the tenant (covenant)

3.Structure and term of the lease

4.Exit strategy

Done correctly, a sale-leaseback offers benefits to both sellers and investors and can be a beautiful exit for owners.

Have questions about sale-leasebacks? Call Chuck to discuss some of his most recent sale-leaseback transactions.