What do start-ups need to know about commercial real estate

The basics of commercial leases

Check out our frequently asked questions at the bottom of this page.

What should you know about commercial leasing?

At first, this can seem like a long and difficult process, but if it’s approached correctly and someone with experience guides the process, it can greatly ease the process.

But before we jump into the process, you must understand something as a start-up.

The risk of working with startup / new tenants - from the landlord's perspective

As a start-up, you first need to realize that you’re an opportunity and a risk to your prospective landlord. If this is an arms-length transaction, you must recognize that the landlord doesn’t know you. The only thing to give them a comfort level is the information you’ve provided and other factors, such as who is representing you and the strength of the offer.

So before you get started in looking for space, the best thing to do is thoroughly understand your requirement. This means you have a business plan, you have revenue projections, you know your margins and how much revenue you have to generate to break even, and you have a roadmap of how you’re getting there.

This may sound like a lot of work, and it is. If operating a business was easy, then everyone would do it. There’s a risk to it, and there’s a reward. The more prepared you are for a business, the greater your chance of success.

So here is what to expect and what to think about as a first-time tenant.

Know the costs associated with the deal

Deposit:

The cost of real estate is usually not the largest expense in most businesses, but you do need to know your total costs on the front end. If your total costs for a new space are $5,000/month, and you’ve signed a 5-year term with a landlord, you may have to pay a deposit of $10,000 - $15,000 depending on what is required. If you’re doing a short-term pop-up store, the landlord may request that you pay the rent for your entire term up-front.

Tenant Insurance:

So that’s your deposit. You’ll also need tenant insurance. This is generally a small cost and won’t break the bank. There are many different commercial insurance providers, such as Lloyd Sadd, HUB International, and Sadler Insurance. If you have an existing business policy with an insurance provider, they can probably add the required insurance to your policy – but as always, check with your provider.

Permits:

A business license is another cost, and in Edmonton, the price of a development permit and building permits will also be a consideration. This is a small cost for most businesses, but can become expensive if there are building permits, etc. The thing that typically hangs people up on permits is the timelines. If you don’t want to be bothered with this at all, development consultants can be hired to run the process.

Construction:

The next item to consider is the premise’s state and what work needs to be done to make the space suitable. Most landlords will require that a certified contractor do all the work because they don’t want amateur trades damaging their buildings. Selecting contractors comes with its own set of challenges.

The cost of any buildout is highly variable based on the selected finishes. If you have a 1,000 sqft space, your cost for flooring can range from around $3,500 on the extreme low end to tens of thousands of dollars, depending on what flooring is selected. For the 1,000 sqft space, your costs can quickly run up into the $100,000s depending on the business and the required renovations.

It will be relatively cheap if your design is simple – four walls, flooring, ceiling, and a bathroom. If you add items specific to your use, your costs will quickly increase. Let’s take a hair salon as an example. In addition to the four walls mentioned above, you’d need hair-washing sinks, upgraded power for dryers, upgraded plumbing such as an extra hot water tank, cutting stations, some cabinetry, a reception desk, and a seating area. You may also want laundry, a color bar, a staff room where people can eat lunch, maybe specific spotlighting, some paint, and a few accents to make the space more unique.

Understanding the costs is critical to successfully launching the business. It's good to have a general idea of your costs and then apply them to the specific space you’re looking at.

Depending on the anticipated costs and your budget, you may be better off renting something similar to what you’re looking for rather than taking a loan to construct the space. Finding a space ready to go (we call this “turnkey”) will significantly help reduce your upfront costs. Still, there will be less room to negotiate in the deal, and you may have to sacrifice some other important elements, such as location.

Step 1: Offer

So now you’ve toured spaces and found one you like. Next, we will look at what kind of deal we can do. This not only includes price (and very often, the price is a fixed feature of the listing), but it also includes deal structure, length of term, incentives on the deal, and any security that the landlord will require.

To some degree, any deal must work for both parties to be viable. If there is a deal to be had, it’s called a “zone of possible agreement” or a “ZOPA.” If a deal is agreed to outside the ZOPA, it will lead to future problems, and one party will often have to terminate the lease. So, a deal has to work.

Keeping interests in mind, we say no deal is better than a bad one. One party may negotiate a deal that’s bad enough that it will be impossible to honor, and the tenant will end up in default. For this reason, knowing your budget and applying common sense when negotiating a deal is essential.

The deal is written and is usually signed by the tenant first. This “offer” is then presented to the landlord, who will have questions and may adjust terms based on their priorities. Once all the adjusting and negotiating are completed, both parties will sign an identical contract. We have a deal.

Step 2: Conditions

Sometimes, the deal will come with conditions, such as a condition for permitting or a general contractor’s construction estimates.

You’ll likely have to deal with some permitting as part of your conditions. This will usually be a business license, a development permit, and possibly inspections from a local authority, depending on the type of business you’re operating. Applications can take several weeks, so the conditional period in your offer should reflect this.

The City of Edmonton has recently changed its zoning bylaw to simplify and expedite this process. The criteria for what businesses can go where is clearer now; we expect this will lighten this requirement.

The landlord may also have a condition to review the tenant’s “financial and corporate covenant.” This means they can request a credit check, business financials, corporate documents, etc.

And finally, we have the formal lease agreement. This document cancels the offer document and becomes the new agreement between the parties. It will include all the terms from the offer to lease and terms that deal with what happens when there’s an earthquake, when the tenant stops paying rent, etc. These documents can vary in length from 4 pages to over 100 pages.

Step 3: Unconditional deal

Once the formal lease is signed, you do have a deal. The next stage in the agreement will be possession; in this stage, you’ll take over the space, do any work that needs to be done, and open it for operation. Typically, the landlord will want the deposit, proof of tenant insurance, and utilities to be switched over into your name before possession.

One thing to note is that no commercial real estate contract is standard. You should read and understand the document to know what you’re getting into, including understanding the dates and all financial commitments you have to the landlord.

If you want more details, or if this isn’t your first rodeo, here’s another article about what to expect when you’ve been in business for a while.

FAQ

We often get asked many of the same questions, and here are some of the most common questions from new tenants.

“I see all of these vacant properties. Isn’t it better for a landlord to do a deal and get some money than to let it sit vacant and make no money?”

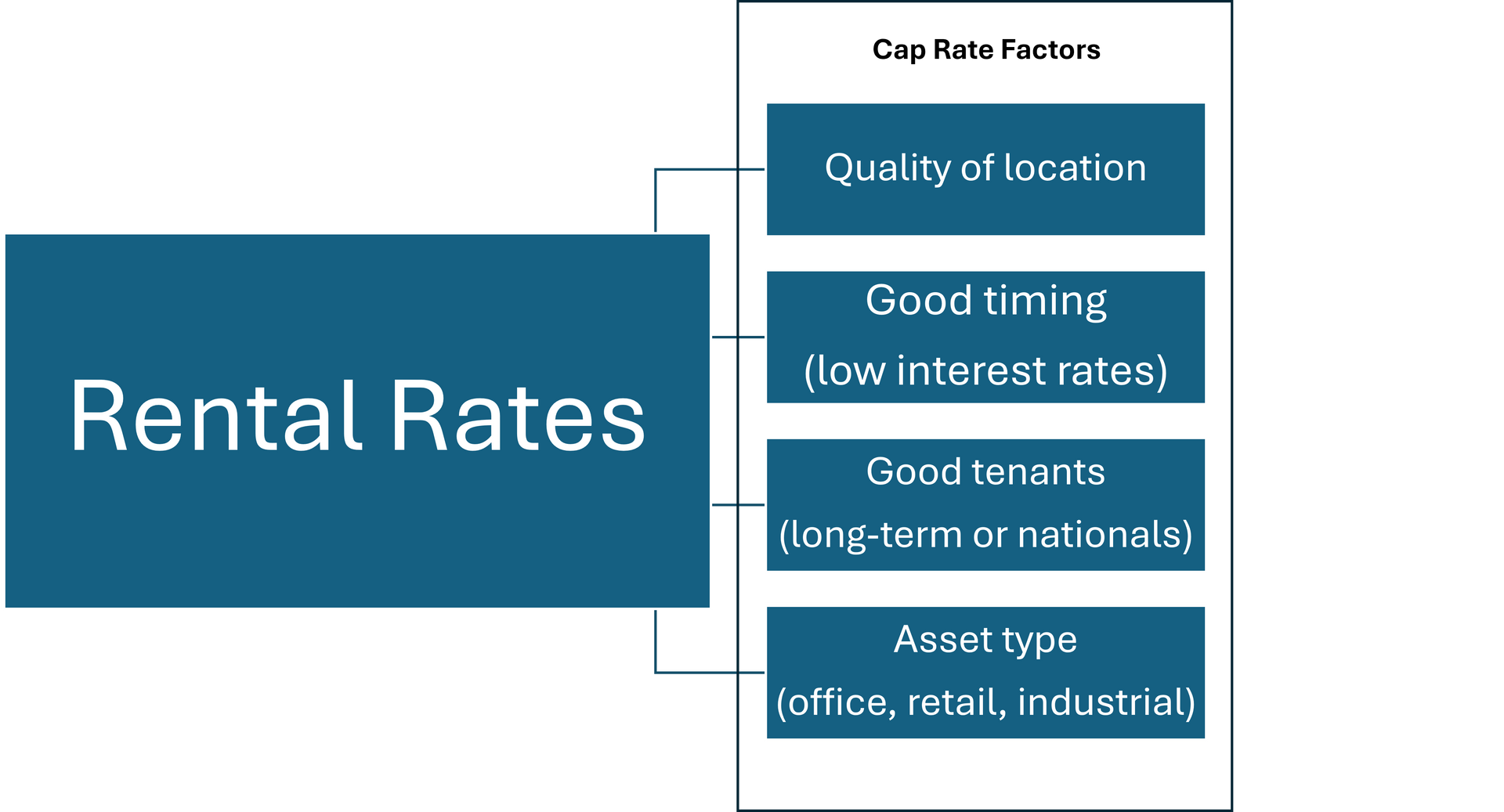

There are several reasons for this. First and foremost, having an undervalued lease in place will devalue the property. Commercial properties are valued based on the rental rate, and if the landlord discounts the rent in the building, they are taking a more significant hit on the value of the building. Sometimes, their bank won’t allow them to agree to a lease under a specific value because it impacts the bank’s ability to handle the property if it goes into receivership.

Some landlords will let a space sit empty rather than lease it out. It will depend on the specific situation.

“Is my deposit refundable?”

In our offers, the deposit is refundable up until the point when conditions are removed. At this point, this becomes a non-refundable deposit.

“What happens if I have to break my lease?”

Usually, you will lose your deposit at the very least. The landlord may seek additional recourse under their lease agreement if this occurs, but it will depend on the landlord and the situation's specifics. If trouble is coming, it’s best to talk to your landlord early to try to work it out. If you break your lease or do a midnight move, be prepared to get lawyers involved.

“Can I get out of my lease early?”

Generally, no. If you commit to a term, you’re committed for that period. However, most leases give the tenant the right to sublet the space, meaning if you can find someone else to take over the space, they will cover most or all of your rent.

“Can my rent increase after the first year?”

This depends. There are two kinds of leases, which are covered in another article. If basic rent and additional rent are separated, then your basic rent is fixed – it will be whatever is in the contract. Additional rent is not fixed and can change annually to reflect the actual costs associated with the property. This doesn’t include mortgage payments but can consist of taxes, maintenance, building insurance, and sometimes utilities.

Want more information? Reach out to me at tom@lizotterealestate.com or text me at 780.920.8019