Retail, office, and industrial real estate - what's the difference?

Pros and Cons with Commercial Real Estate Asset Classes

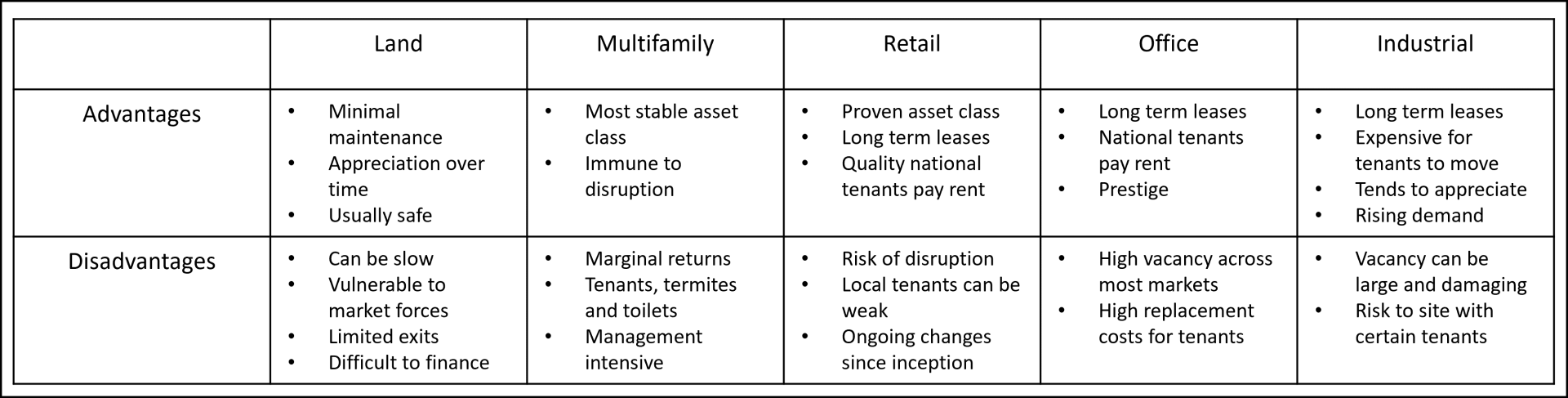

Commercial real estate presents endless opportunities for investors, but when it comes to picking the right asset, each one comes with its own risks and plus-points.

Most investors will eventually settle on one or two asset classes into which they specialize. What asset they choose has a lot to do with the individual investor's priorities, temperament, and risk tolerance.

There are endless ways to delineate investment real estate, but we will focus on five main classes for this presentation, these are land, multi-family, retail, office, and industrial real estate.

Land

Don't wait to buy land, buy land and wait.

This is a bit of common advice among land buyers.

The play with a land buyer is typically simple. They will purchase the land, wait for it to appreciate, then sell it to another investor with a health upside – that's the plan anyway. Usually, this is a safe asset class, and unless the entire marketplace collapses (think Detroit), the land can usually be sold. Even in a situation where land value collapses, the investor will be in a good position to hold it, since property taxes will no doubt collapse as well. Most of the time, a simple appreciation play will work, given enough time.

Land is typically bought with cash since many banks will be unwilling to finance land. The only real income that will come from land is renting it as yard storage or allowing farmers to harvest hay – both of which will do little more than pay the property tax.

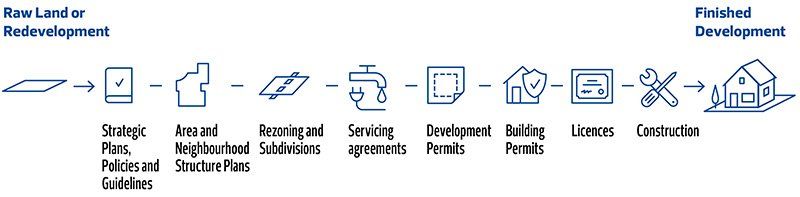

Some investors will also move the land forward towards development, thus making it faster to turn a profit. In Edmonton, the land development process looks like this, and a similar pattern will be followed in many major cities:

For example, a developer may take a piece of raw land, rezone the property, provide services up to the property line, and rough grade the site. This is work that any developer would have to do. The investor putting in this investment (sometimes considerable in both time and money) saves a future buyer from doing this work and adds value to the site.

Most investors fall into the land banker category, but some will be willing to take on the additional work in moving the property towards development.

Multi-family

Multi-family is probably the category most familiar to investors. Many small investors start their investment journey with single-family homes, moving into duplexes, fourplexes, and forward into larger projects.

The beauty of multi-family is that it isn't going away, and it is immune to disruption. People will always need a roof over their heads, and multi-family has been a requirement for humans since we emerged from caves.

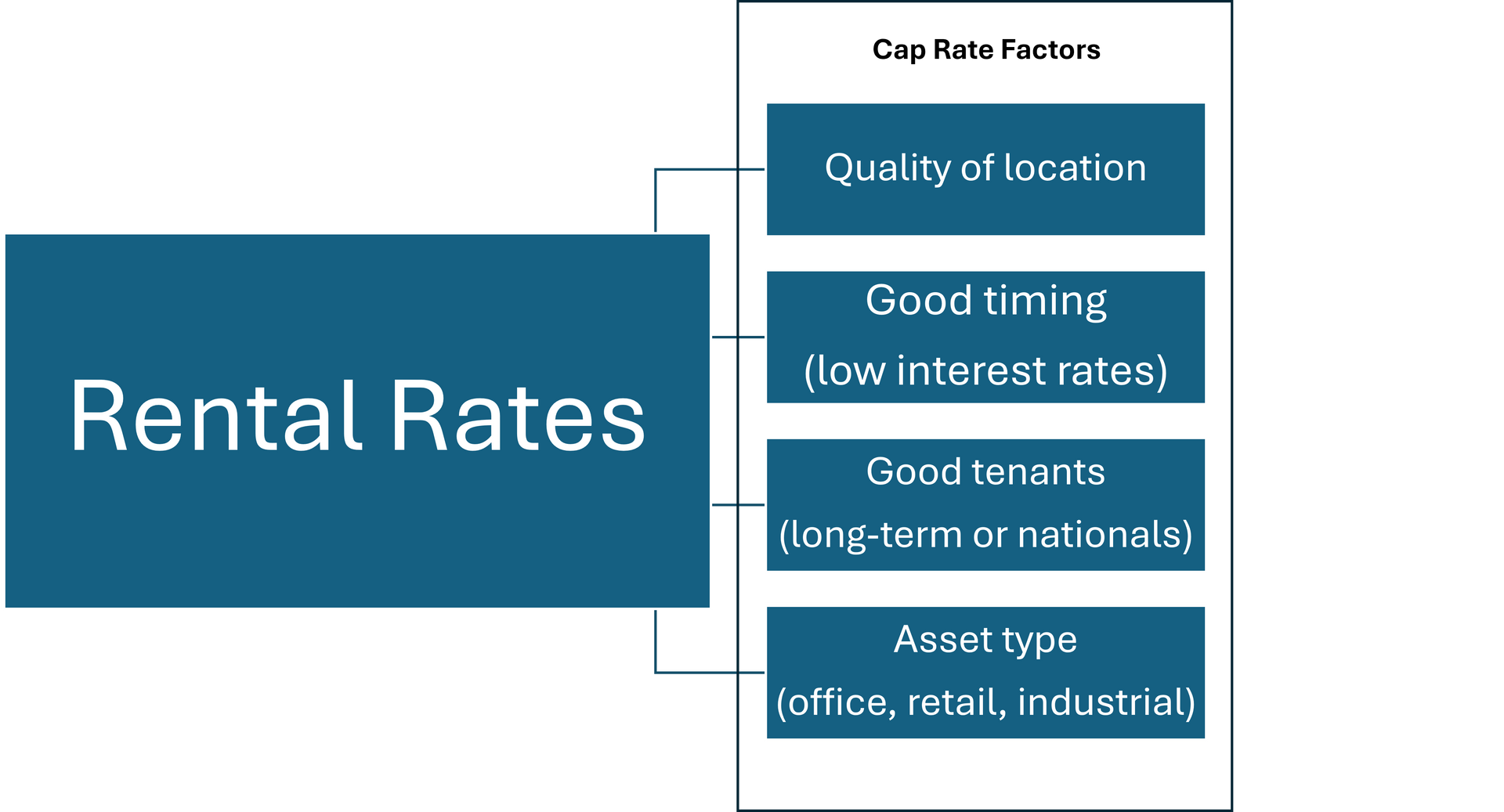

So the asset is very safe, and for this reason, there is a high demand for this asset class among investors. This pressure drives value down, so the main factor in determining appropriate cap rates for multi-family assets will be the cost to finance the property. Returns will generally be modest, but there will be returns. Management intensiveness in small portfolios is the greatest challenge with this asset class, but this improves as the portfolio grows enough to justify using a professional property manager.

Multi-family has subcategories that do not share the fundamentals of a typical multi-FAMILY building. For example, student housing is a different category of multi-family. This shares the characteristic that many people live in the building, however, students go home to their families, creating a periodic vacancy. Student housing is fundamentally tied to another industry (education) that is going through massive disruption. Most of these properties will not easily be able to pivot to make up for these changes.

Retail

Retail splits up into several subsets, so much so that when someone says they invest in retail, it will be ambiguous as to what this means.

The main factor in all retail types is the disruption of online shopping. This has caused most categories of retail outside of QSRs and restaurants to pivot to survive.

Strip malls are the most common form of retail property. These were developed in the early 20th century to make a retail marketplace more friendly towards automobiles. These tend to be highly efficient and well-oiled machines, with the perfect ratio of parking to usable floor area. These plazas are highly in demand, so cap rates on retail plazas tend to be lower than in most other asset classes.

Urban street front is a subset of the strip malls above and is really a smaller version of the same concept, using public property for parking. This asset class will typically be mixed-use, having a residential or office component on the upper floors.

Enclosed malls are another retail creation. This is an enclosed market street front with no cars. People park in the acres of parking surrounding these centers and go inside to shop in a space not exposed to the elements. This asset class has been disrupted in recent years and is pivoting into a more experiential retail model.

Office

Office is yet another asset that's been disrupted by the digital revolution. In most markets across North America, there is more office space than can be absorbed. The result is that the office market is risky.

Costs associated with replacing tenants constitute a significant consideration in this asset class. In Edmonton, lease transactions are currently being completed around $0 net effective rent, meaning that the landlord sees minimal money out of the deal. As a result, demand is low, and cap rates and returns are relatively high, but those high cap rates come with risk.

In most markets, downtown office vacancy will be lower than suburban, but the entry barriers (cost) are high to get into the market. Vacancy can be a significant consideration, and planning an exit or repositioning an asset can be challenging and costly. With all of that said, owning office buildings, especially towers, comes with a level of prestige that is not associated with other asset classes.

A subset of office space is medical office. This space shares most of the characteristics of the standard office noted above, but the numbers tend to be larger, and the tenants changing costs (buildout for their spaces) can be astronomically high, giving the landlord increased leverage in negotiations with existing tenants. The costs to acquire new medical tenants also tend to be very high.

Industrial

This category has two distinct subcategories, one is manufacturing/production, and the other is distribution.

Distribution focuses on central transit/commercial nodes, including highways, intermodal train yards, and airports. These spaces tend to have dock loading for ease of loading and unloading containers. This is an up-and-coming asset class with astronomical potential as it disrupts conventional retail. The challenge with this investment is that there aren't as many small distributors, thus making meaningful investment in this asset class a costly venture.

Manufacturing and production are just what they sound like. These are the factories, chemical plants, laboratories, and auto shops. Anything that produces something tangible is in this asset class. Like medical, the switching costs for tenants tend to be high, and once the equipment is set up and operations are established, these businesses tend to stay in place long term and not require any work on the part of the owner. The risk with these spaces is when your tenant does move or go out of business, it can be years before the space is filled again.

Additionally, there are environmental risks with some tenants. These risks may not have been regulated throughout the business time of the tenant. So there may be multiple violations and issues that need to be remedied before a bank lending money on a contaminated asset.

As an asset class, industrial real estate enjoys health cap rates due to lower demand than some other asset classes. This is partly due to the risk of the asset class and the optics around some uses and "dirty" buildings. For this reason, there are many good opportunities in this investment class.

Conclusion

How much money do you have? How much time do you have? How much risk do you want to take?

Those are the big questions for investors.

Investors need to do some soul searching before investing in properties. Do they want a passive investment, such as land, industrial or medical space can provide, or are they looking for a second job, such as multi-family assets can provide.

Barriers to entry are another consideration. Again, multi-family is the most familiar and can be relatively easy to finance, whereas industrial space and land can have high costs in the beginning and can be hard to finance.

There are endless opportunities in this arena, and it's a great industry to take part in.