What is covered land in commercial real estate?

What is covered land in commercial real estate?

What is covered land?

This is an occasional question we get from real estate investors, especially from those in the space of land banking and redevelopment.

Put simply, covered land produces income to "cover" the expenses associated with a project or the holding period of the property. These expenses can be property tax, debt service, or other costs.

This need not be bare land, and often, it is not bare land. Covered land can refer to a parcel of land with a building on it, where the site is not meeting the criteria of "highest and best use." This means potential upside for a buyer down the line if the property can be redeveloped or is suitable for a future land play.

Another benefit of a covered land deal is that it's often easier to finance. If the property has a building on it that pays income and services debt, then the deal is probably bankable. Compare this to other land deals where you must have significant equity to purchase a parcel.

An example of this is a single-story restaurant business that's been in operation for 50 years in one location. If an investor buys the property as a leaseback with a 10-year lease in place that pays only nominal rent but covers the expenses to the new owner, the investor is essentially covering his costs to buy the land with future redevelopment potential. The useful life of the building may be short, perhaps 10 – 15 years, but this scenario is still preferable to purchasing land at a premium with no income and the intent to hold the property.

Another possible scenario is this. Suppose you own a strip mall on a busy road but doesn't directly abut the intersection. You want to buy the building and land bordering the intersection, but the neighboring building owner operates their business out of the space, and doesn't want to close their business. A covered land deal is a possible "win-win" for the parties. The strip mall owner could buy the parcel on a "net and carefree" lease basis. The seller gets to cash out now and perhaps has an agreement in place that the site may only be demolished after the owner retires or dies (or some other sunset criteria). This also secures the buyer's interest in the property and will increase the value of his neighboring strip center.

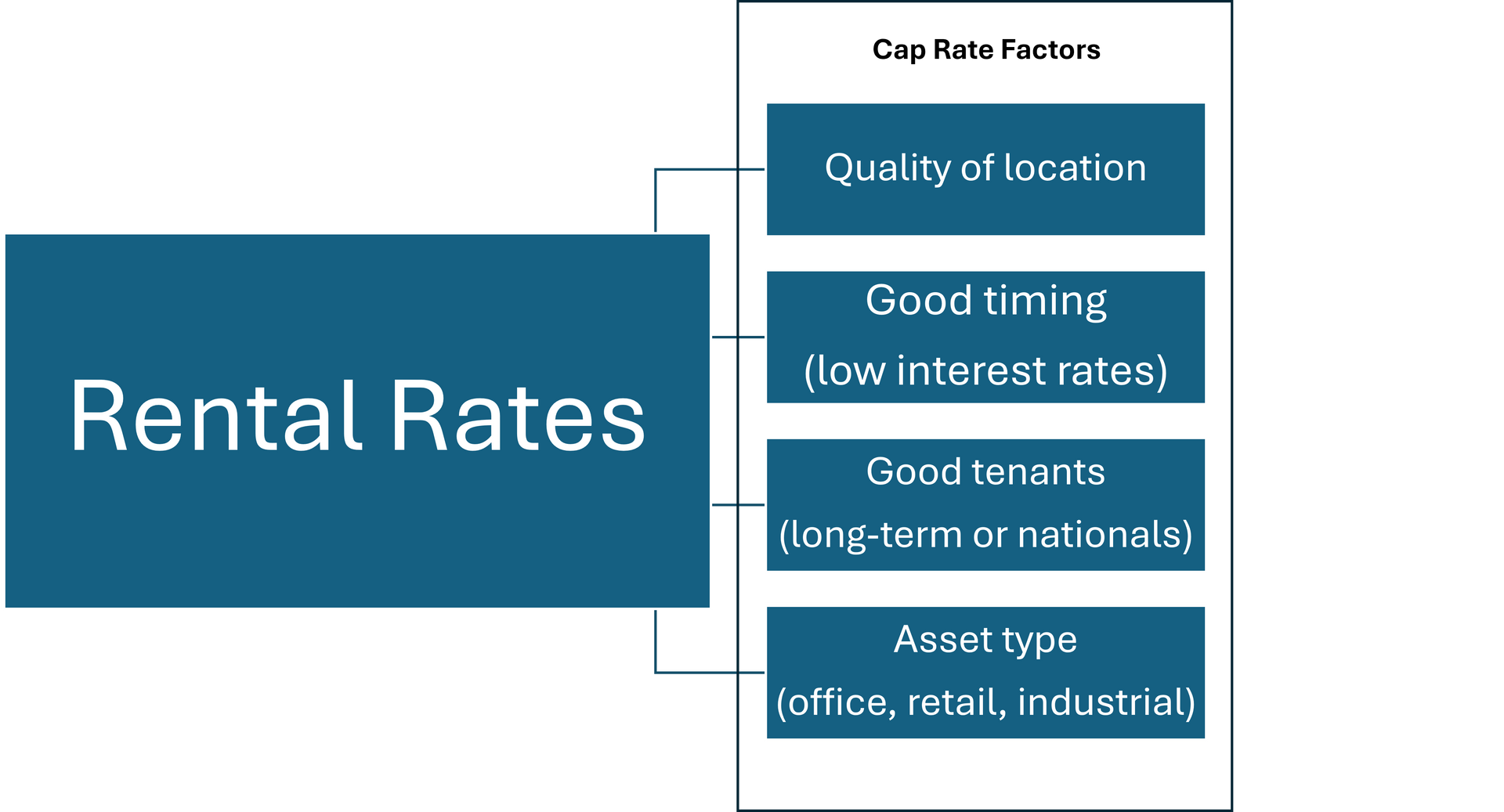

The risk with this investment type is the same with any other investment. If you overpay based on cap rate or the strength of the operating business, you may find yourself upside down when your tenant leaves, or it's time to sell. The key with a covered land deal is that you're buying the land, not the building or business, so the entire play needs to be based on a land exit. If you miss the mark on your speculation, you'll lose money.

Overall this is a safe investment strategy if done correctly and, in my opinion, preferable to a greenfield land bank play since a covered land deal should cover the expenses.

If you have a deal you'd like us to look at, reach out to myself, or Chuck for help.