What is gross up factor?

Rentable vs usable space in commercial leases.

“Rentable

space / Usable Space = Gross Up Factor”

You know how, when you pay your taxes, some of that money is going to roads, maintenance or government buildings, parks and various other amenities in your municipality? Paying this tax is paying money for something that you use, but you don't own it - it belongs to everyone and is for use by everyone. The same thing happens in commercial real estate, and these are called "common areas" and how they're determined in a lease is generally through the gross-up factor.

In addition to renting the space in which their occupying, tenants also pay for a portion of the common areas that they use. Gross-up can include hallways, washrooms, lobby, amenities such as gyms, common showers, bike lock up, etc.

Usable area is space a tenant occupies, what they can “use”. The rentable area includes the gross-up of the space.

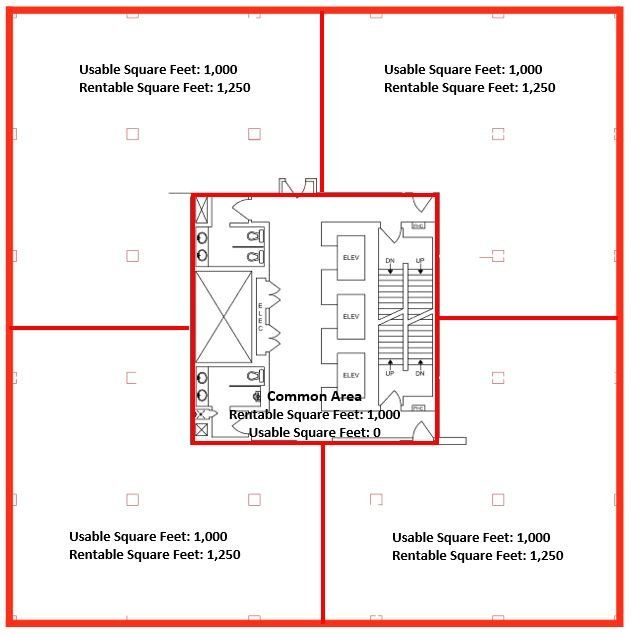

As an

example, if a building has a footprint of 5,000 Square feet, then the building

has 5,000 Square feet per floor of rentable area. If each floor then has common

area washrooms and a lobby, all of which measures 1,000 Square feet, then the

remaining 4,000 Square feet is the usable space. This space has a gross-up of

25% (5,000 / 4,000 = 1.25). If 4 tenants of equal size occupied the floor,

their usable space would, therefore, be 1,000 Square feet, and their rentable space

would be 1,250 square feet.

Generally, all calculations in a lease are based on the rentable area. So basic and additional rent are charged on the grossed-up amount, in other words, you pay for 1,250 square feet, while you occupy 1,000 square feet. All tenant improvement allowances and other incentives are based on the rentable area, if you negotiate a $10 tenant improvement allowance, it's calculated based on the 1,250 square foot rentable area.

Gross ups are most common in office buildings, tending not to apply as much to retail strips or industrial buildings. Interior malls tend to increase base rent rather than gross the space up. So mall tenants, especially food court tenants, will have the common areas of the space factored into their lease rates. This leads to lease rates of several hundred dollars per square foot on spaces with a 300 square-foot footprint.

Want to know what a typical gross-up factor is in Edmonton, contact usto learn more.